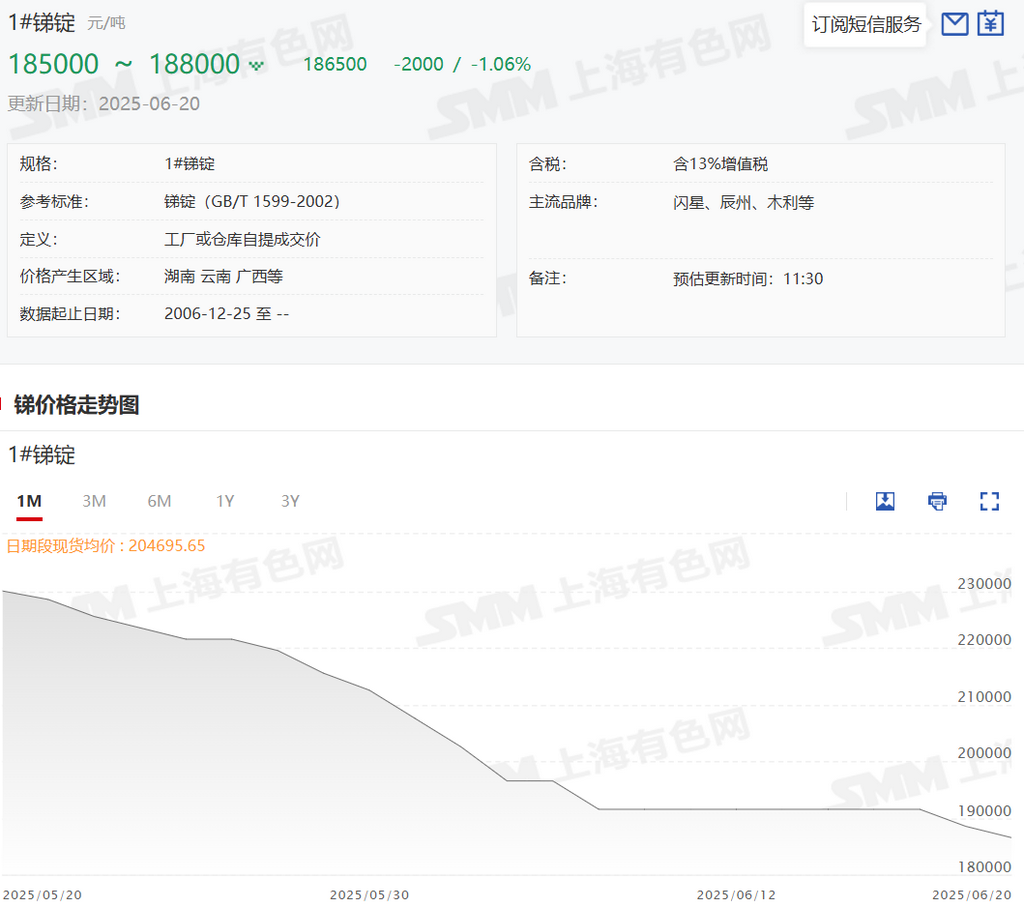

SMM News on June 20: After a period of stability, antimony prices have once again shown a certain decline this week. Currently, the significant suspension of imported ore entering the domestic market has led to a tight supply of domestic antimony raw materials. Additionally, the overall inventory of antimony products among domestic producers is at historically low levels. As a result, producers are generally maintaining stable quotes. In the domestic end-use market for antimony products, orders for both flame retardants and PV-related antimony are basically stable. Although there has been no recent improvement in orders from end-users, the situation has not deteriorated either. Overall, just-in-time procurement is proceeding smoothly, with end-users purchasing as needed without stockpiling. However, the sentiment in the speculative market remains slightly volatile, with some low-priced supplies still being traded. Market participants indicate that the availability of significantly low-priced resources has begun to decrease noticeably, and their impact on market price trends has also weakened significantly. As of now, the SMM average prices for antimony are as follows: 2# low-bismuth antimony ingot at 180,500 yuan/mt, 1# antimony ingot at 186,500 yuan/mt, 0# antimony ingot at 190,500 yuan/mt, and the average price for 2# high-bismuth antimony ingot at 177,500 yuan/mt. Regarding the market prices of antimony trioxide this week, as of now, the SMM average prices for antimony trioxide are: 99.5% purity at 162,500 yuan/mt and 99.8% purity at 173,500 yuan/mt.

Recently, through official sources, it has been learned that since June, a large number of antimony smelters have halted production, including many flagship domestic producers. Based on the current operational status of over 30 antimony smelters tracked by SMM nationwide, approximately 20 have ceased production. Coincidentally, a similar situation occurred in the second half of June last year, when more than half of the smelters also halted production.

For instance, in south-west China, antimony smelters represented by a certain antimony enterprise in Yunnan have fully suspended production. In central China, a major antimony smelter in Lengshuijiang, Hunan, has announced a complete shutdown, including its fine metallurgy plant, with some units undergoing maintenance. The restart time is uncertain, possibly not until August or even September, during which antimony production will be affected. Most other smelters in the Lengshuijiang area of Hunan are also currently fully shut down. Many large smelters in other parts of Hunan have either halted or reduced production. In south China, some smelters have halted while others remain operational, such as a certain precious and rare metals smelter in Guangxi, which has currently suspended production. Antimony smelters in Guizhou are also almost entirely shut down. Market participants indicate that the production halts are particularly noticeable in Guangxi and Guizhou, possibly due to recent environmental protection measures. In other regions, such as Hubei and Shaanxi, smelters remain in long-term shutdowns. Many market participants suggest that in the coming period, the number of antimony smelters in China capable of normal operations may be countable on one's fingers, a rare situation that has occurred consecutively in the past two years. Furthermore, based on the shutdown plans of the aforementioned smelters, the time for resuming production remains unclear, and it is expected that the recent antimony production volume will be significantly affected. Apart from maintenance reasons, the main cause for the shutdowns of some smelters is the lack of sufficient raw materials for smelting production. If these smelters are unable to purchase and replenish raw materials in large quantities in the short term, even if production resumes, output will be limited to a relatively low level. Some market participants also indicate that currently, ore resources are both expensive and scarce, while the selling prices of downstream products are low and difficult to sell. Producers, caught in the middle, are indeed facing significant challenges. Reducing production through maintenance and shutdowns may be a better adjustment. Market participants also assess that antimony smelting production in June this year, and even in Q3, may potentially reach new lows.

Currently, for manufacturers still in operation, some have stated that their top priority is to maintain a stable supply of raw materials and steady sales. During interviews, some representatives from manufacturers also expressed that, based on recent insights into the national mining and smelting sectors, they remain confident and optimistic about the medium and long-term market trends for antimony. They currently believe that the actual domestic supply is less than the demand. However, end-users are exerting significant pressure on procurement volumes and raw material inventories. Nevertheless, they remain bullish on the future of essential demand. Therefore, the current focus is on stabilizing production volumes to ensure there will be products available for sale when the market recovers.